INTERVIEW WITH PRIMO SPACE

Primo Space, a venture capital fund specialising in investments in the New Space Economy, is already a major partner of Φ-lab following an agreement signed last year. Michele Castorina recently sat down with Primo’s Raffaele Mauro to hear his take on New Space in Europe.

Ciao Raffaele, thanks for taking the time to share your thoughts with us today. To start us off, can you tell us how you see the current state of the European space arena and how Primo Space is interfacing with it? What are the synergies to be had in terms of initiatives from the likes of ESA, the European Commission and national institutions?

Well I’m happy to say that Europe is demonstrating a robust evolution of its space industry, with an expanding private sector growing in line with the new logic of the space economy. The focus is on expanding access to space, reducing costs, generating smart applications and creating a real impact on society. From the point of view of a venture capital fund like Primo Space, it is essential to build partnerships and collaborate with the ecosystem, from research institutes to space agencies, from large corporations to government bodies. Synergies can be generated in the areas of tech transfer processes, start-up acceleration, help for Europe-wide scale-up processes and general education.

What’s your assessment of the state of play of EO space start-up in Europe? Where do you see high potential for development?

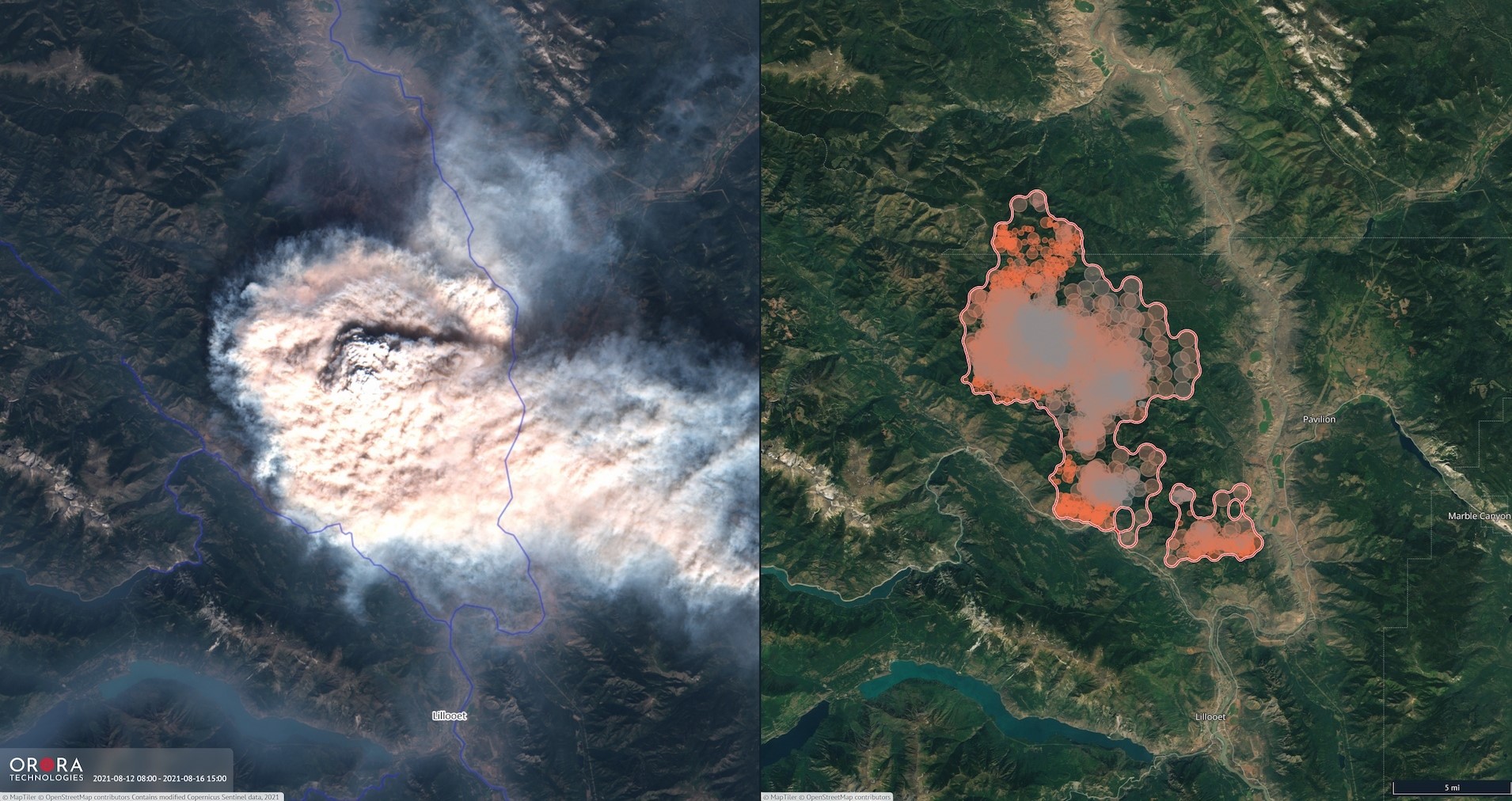

I think several challenges identified as key future policy objectives by the European Union could benefit from Earth observation technology. For instance, environmental protection and climate change monitoring are significantly empowered by EO capabilities. Forestry, sustainable agriculture, ocean protection, water resource stewardship, extreme weather prediction and urban development monitoring are all examples where space infrastructure could help the achievement of green policy objectives.

Special Purpose Acquisition Companies, or SPACs, are becoming more popular and attractive in the space sector. Although they’re considered very effective in delivering initial capital, there are some question marks over the long term efficacy of SPACs. Of the many SPAC initiatives launched over the last year, very few have a current valuation which has grown compared with their pre-flotation value. What’s your view of SPACs and what do you feel are the risks, if any?

There are two sides to be considered regarding SPACs. The first is that they are part of a wider increased capital allocation in spacetech companies, which is generally a positive evolution because in the past space start-ups were perceived as too risky, too complex or too costly. The fact that there are now multiple new sources of private capital is enabling a new generation of ‘astropreneurs’, which in turn is creating positive externalities. On the other hand, it’s true that there was excessive exuberance in the markets regarding tech companies in general, partially caused by the past macroeconomic environment with extremely low interest rates. In particular, the last few years have seen overheating regarding SPACs and sometimes overshooting of company valuations, which inevitably leads to the risk of backfiring for some of them.

Italy has now planned to use a substantial part of its EU Recovery and Resilience Facility [Italy’s NRRP, the National Recovery and Resilience Plan] to deploy an EO constellation with ESA technical support, and other European countries are considering similar investments in space. In your view, what will be the effect of such stimulus measures on the Italian space start-up industry? What should be done to maximise the benefits from this public investment?

With these recent developments there are good opportunities for the Italian space start-up ecosystem. The industry now has a significant level of attention, and part of Italy’s NRRP funding will be allocated for investments in private space companies, with Earth observation being one of the best sectors for generating links with the real economy and effective business models. In terms of how to maximise the impact of public investments, these incentives really need to be allocated in collaboration with the private sector, ideally by preserving market incentives with indirect investments and matching or co-investment schemes.

Thanks so much Raffaele for your invaluable insight.